Competitors

12

🚀

Discover 50+ More Competitors

This is just the tip of the iceberg. Unlock comprehensive insights into your competitive landscape.

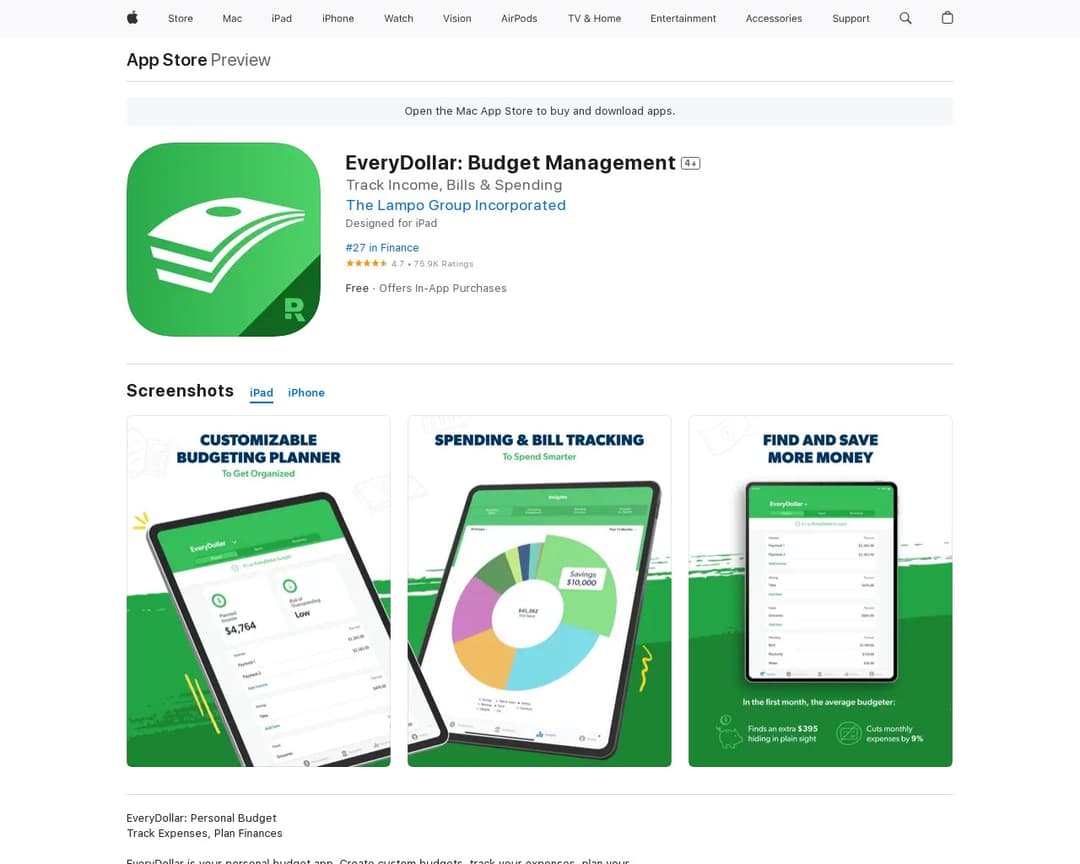

Unlock Full ReportEveryDollar is a personal budgeting and expense tracking application that helps users create custom budgets, track spending, manage accounts, and set financial goals. It offers both free and premium features, including automated bank connections and financial coaching sessions, to help individuals manage their money effectively.

2 of 5

Category-Based Content Library

Newsletter Subscription

Search & Filter

Popular & Trending Sections

Multimedia Content Support

1 of 10

Responsive Design

Social Sharing

Tag-Based Navigation

Related Articles Recommendation

Author Profiles

SEO Optimization

Iframe Embeds

Analytics & Tracking

Archive by Date

Comments or Feedback

EveryDollar is primarily a budgeting and expense tracking app, which is different from a content-driven financial education platform. While it offers some financial guidance through its parent company Ramsey Solutions, its core product is not a content library. However, it does offer some categorized content (e.g., articles and guides on budgeting, saving, debt, retirement) and a newsletter subscription through Ramsey Solutions. The app itself is responsive across devices.

I've been using Alternative A for 6 months now and it's been fantastic. The pricing is much better and the features are actually more robust than what [Product] offers.

It handles edge cases much better and the API is actually documented properly.

Check it out at our site.

Honestly, after trying both, Competitor B wins hands down. Better customer support, cleaner interface, and they don't nickel and dime you for every feature.