Competitors

12

🚀

Discover 50+ More Competitors

This is just the tip of the iceberg. Unlock comprehensive insights into your competitive landscape.

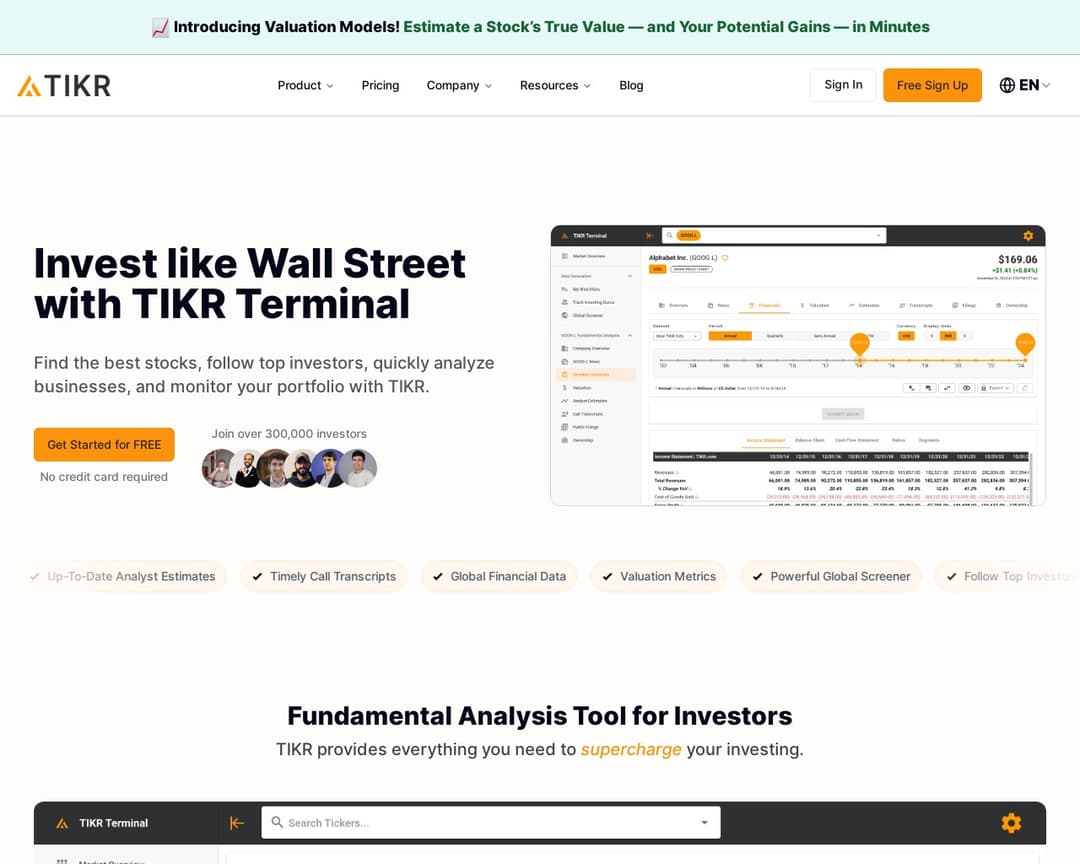

Unlock Full ReportTIKR is a stock market research and investor analysis platform providing high-quality data and tools for global stocks. It enables users to follow top investors, analyze businesses with in-depth metrics, and monitor their portfolios. The platform offers a powerful global screener and access to financial data, analyst estimates, and call transcripts.

3 of 5

Category-Based Content Library

Search & Filter

Multimedia Content Support

Newsletter Subscription

Popular & Trending Sections

2 of 10

Responsive Design

SEO Optimization

Social Sharing

Tag-Based Navigation

Related Articles Recommendation

Author Profiles

Iframe Embeds

Analytics & Tracking

Archive by Date

Comments or Feedback

TIKR is primarily a stock market research and investor analysis tool, offering high-quality data and tools for global stocks, portfolio monitoring, and company analysis. While it has a 'Resources' section with articles categorized into 'Stock Market Basics', 'Fundamental Analysis', and 'Investing Lingo', which aligns with 'Category-Based Content Library', and it supports multimedia content like charts and graphs, it is not a content-driven personal finance education platform in the same vein as 'Fluent in Finance Platform'. It lacks a dedicated newsletter subscription for educational content, and its search and filter capabilities are more geared towards financial data screening rather than content discovery. The core value proposition is data and analysis, not broad financial literacy education.

I've been using Alternative A for 6 months now and it's been fantastic. The pricing is much better and the features are actually more robust than what [Product] offers.

It handles edge cases much better and the API is actually documented properly.

Check it out at our site.

Honestly, after trying both, Competitor B wins hands down. Better customer support, cleaner interface, and they don't nickel and dime you for every feature.